“The slowdown in growth that we are seeing in the beauty industry is a reflection of an industry stabilizing after strong double-digit performance for the past two years,” said Larissa Jensen, Global Beauty Industry Advisor at Circana. “But we should not underestimate it’s strength, as sales grew by over $600 million in Q1.”

Fragrances drive prestige sales

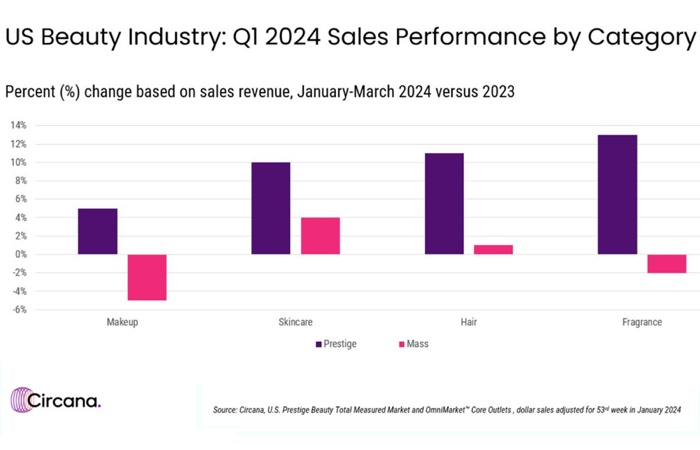

Within the prestige channels, fragrance was the fastest-growing category based on sales revenue, up 13% in the first quarter of 2024. Gift sets grew by 22%; travel size sets inclusive of discovery sets grew at double the rate of traditional full-size sets.

While the fragrance category is experiencing a trading down in terms of price, with the growth of travel- and mini- sized product, there is simultaneous growth happening in the luxury sector – with units sold growing at more than double the rate of the remaining prestige market in Q1.

Skincare shines in mass market

Skincare dollar sales increased by 10% in the prestige channel and was the fastest-growing category in the mass market, Circana reports. Consumer spending was up double-digits in Q1 compared to the same period last year, according to Circana’s Checkout data. Additionally, there were more buyers, both spending more money and purchasing more frequently on skincare products.

Body spray was the top gainer in the skincare category, as sales have nearly tripled since Q1 2023. Face serum was the second strongest performer, driven by new launches from top clinical brands.

Lip makeup drives makeup sales

Makeup wrapped up Q1 as the softest-performing category in both the prestige and mass markets.

Despite the slowdown, makeup remains the largest prestige beauty category. Lip makeup was the strongest performer, with sales up 26% based on dollars sold in Q1. This was led primarily by tinted lip balms and oils, which are among the hottest makeup products and new launches continue to populate the market.

Hair care remains a strong performer in prestige

Prestige hair product sales continued to grow double-digits in Q1. Hair wellness continues to rise in importance, which is evident by the performance of hair thinning and loss products, hair oils and serums, scalp care, and heat protectants, which all grew sales between 13% and 25% during the quarter.

From a brand type perspective, salon brands remained the top sales contributor, but celebrity brands grew the fastest, up 64%.

For the record, U.S. prestige beauty market had seen growth of 14% for the whole of 2023 and 15% in 2022.